Your Partner, in Crypto

Tailored for private wealth, Aspen Digital provides an independent platform enabling clients to leverage our sector expertise, exclusive global access and best in class technology to build bespoke digital asset portfolios. With our client first approach we educate and advise on allocation strategies across venture capital, hedge funds and trading.

© 2025 Aspen Digital Financial Limited.

Regulated by the ADGM FSRA (FSP Number: 240034)

Our Investors

Founders

Backed by prominent families and investors, Everest Ventures Group is a global team of 300 serial entrepreneurs, engineers and product managers in their 20s & 30s, with venture partners and sister companies on both sides of the Pacific.

EVG has built and launched a diverse portfolio of products for the future of digital interaction across use cases. As an early investor and lead advisor, EVG has also contributed to unicorns and 100+ defining projects such as Dapper Labs (Flow), Animoca Brands, Immutable, The Sandbox, Yuga Labs, Kraken, Lukka, and Upbit.

TTB Partners (“TTB”) is a financial services platform focused on principal investing, advisory and wealth solutions. Based out of London, United Kingdom, TTB’s business spans private equity, corporate finance, venture capital, sports, digital assets and real estate.

RIT Capital Partners plc, formerly Rothschild Investment Trust, is a large British investment trust dedicated to investments in quoted securities and quoted special situations. Established in 1961, the company is listed on the London Stock Exchange and is a constituent of the FTSE 250 Index.

Our Services

Capital Markets

Invest in and custodise cryptocurrencies with sophisticated buying strategies across trading and structured products as well as accessing top venture opportunities through our extensive global investor, fund and founder network

Private Wealth Management

Leverage our technical and deep sector expertise to help design and build customised portfolios across the sector. We provide advisory and portfolio management solutions combined with exclusive access to the top managers and platforms

Infrastructure Solutions

Launch in house digital asset capabilities through our custom branded white label solution. Our modular SaaS infrastructure enables wealth managers and multi-family offices to design a full service technology platform to extend their asset class coverage

Our Clients

Sophisticated investors from family offices and high-net worth individuals prefer similar experience as they would in a private bank model to access products in the digital asset class:

Capital Markets

Private Wealth Management

Asset managers may have either discretionary mandates or acting as gatekeepers to research the space. Aspen Digital can offer both a direct B2C solution and a B2B technological platform play:

Capital Markets

Private Wealth Management

Infrastructure Solutions

Financial institutions aim to offer the largest display of products for both their own investments and for clients' portfolio allocation, thus can tap into Aspen Digital's B2C and B2B offerings:

Capital Markets

Private Wealth Management

Infrastructure Solutions

Aspen Digital offers a SaaS/White-label solution of our existing portal, enabling providers to quickly connect to a complete platform that allows clients to immediately allocate:

Infrastructure Solutions

Research Highlights

Our team creates regular digital assets market insights through weekly newsletter, externally-collaborated research reports and more.

Research Report — Current State of Digital Asset Treasuries

Digital asset treasury companies (DATs) have emerged as the new frontier of corporate finance and capital strategy. DATs adopt digital assets as a primary strategic function. Instead of a merely passive crypto holder, DATs are sophisticated capital markets vehicles engineered to provide investors with amplified, regulated exposure to digital assets.

How to spot high quality DAT?

Digital asset treasury companies (DAT) allow TradFi investors to gain crypto exposure without directly owning it.

Top 5 Strategies by Market-Neutral Fund Managers

Market-neutral strategies are designed to generate returns that are largely independent of the overall direction of the crypto market.

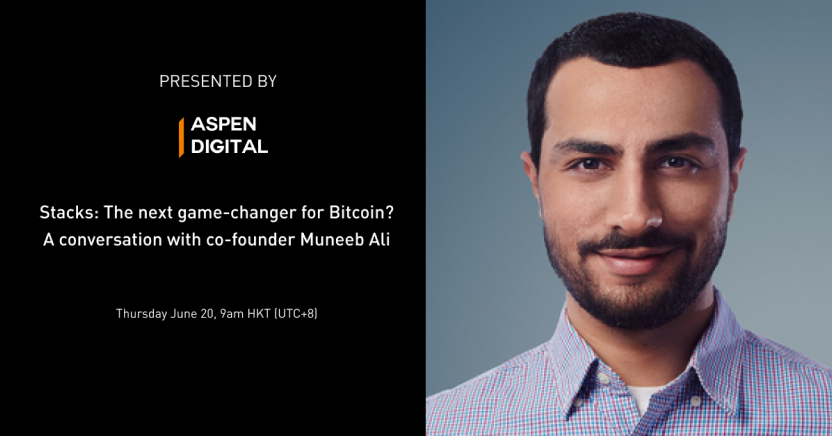

Past Events

Our team creates regular digital assets market insights through weekly newsletter, externally-collaborated research reports and more.